1. Google’s decision to delay and suddenly enforce its cookie shutdown

Google’s decision to delay and suddenly enforce its cookie shutdown will have a major impact on digital marketing, causing disruption in holiday campaigns and personalization strategies.

It seems that Google’s cookie shutdown in early 2024 may face another potential delay, despite their initial promise to proceed cautiously. Anticipate brands and publishers to once again procrastinate in getting ready for a cookieless future. This is where things could potentially turn unpleasant.

Without warning, Google suddenly decides to fulfill its plan by swiftly shutting down cookies to meet the pressing Q4 deadline. Similar to a marketing analyst, the consequences would be far-reaching and distressing. We would probably witness a substantial decrease in performance during the holiday shopping season, resulting in marketers failing to meet their targets and consumers feeling dissatisfied with generic experiences and product suggestions. – Alexandra Theriault, Chief Growth Officer at Lotame.

2. The Ascension of SSPs

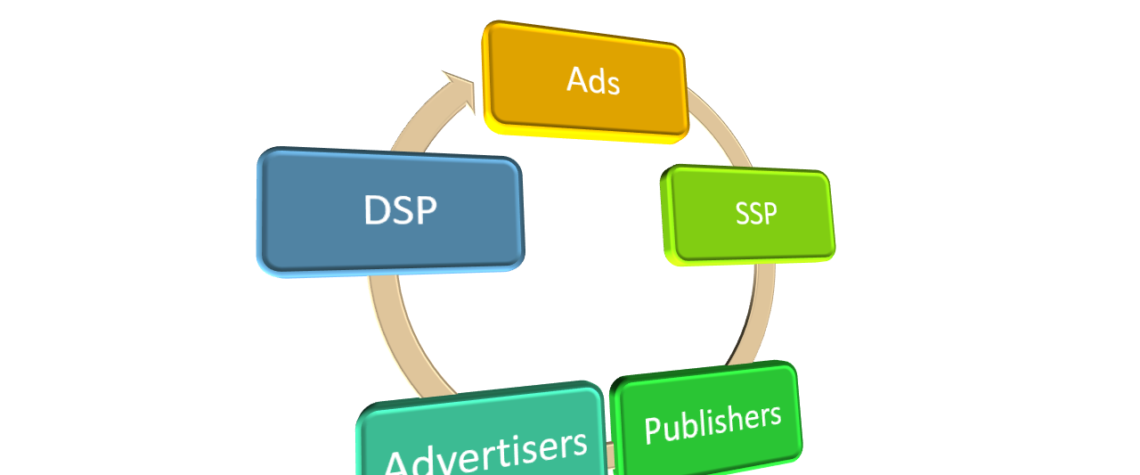

In the ever-evolving world of ad tech, the emergence of Supply-Side Platforms (SSPs) is set to revolutionize audience discovery and targeting. With the decline of cookies, SSPs will play a crucial role in reducing the dependence on traditional intermediaries in the digital advertising landscape.

In 2023, there was a strong emphasis on streamlining the supply chain. Several prominent adtech companies have sought to expand the boundaries that separate the buying and selling sides. In 2024, we can expect further convergence between SSP and DSPs, efforts to simplify supply paths, and stronger partnerships between publishers and advertisers. Marketers will continue to prioritize inventory control, transparency, and streamlined access, as demonstrated in the CTV industry.

In the post-cookie era, there will be a greater need for SSPs to handle audience discovery and targeting. Agencies should consider using curation as a tool to achieve supply-path optimization (SPO) and addressability upstream. In general, there will be a decrease in the dependence on intermediaries who impose fees that do not contribute to tangible value-added and key performance indicators.

3. The clean room technology sector

This sector is expected to undergo consolidation, with a handful of major players emerging as dominant forces. Companies like Google and Snowflake are poised to lead the way, thanks to their advanced capabilities and significant investments.

This sector has received a lot of attention in recent years. Given the significance of this technology, it seems that there may be an excessive number of newcomers in this field, potentially resulting in a limited number of frontrunners. This technology is still in its early stages, and it is crucial to conduct testing for different use cases.

Meanwhile, there will be an increasing demand for clean rooms owned by specific tech platforms like Google’s or AWS Cleanroom. And Snowflake shouldn’t be underestimated. With its substantial resources and investments in the industry, along with the advantage of being built on AWS, it has the potential to emerge as the final independent company in the market.

4. Large Content Creators to Outshine in CTV Segment.

In the CTV space, larger content creators such as Netflix and Disney are expected to outshine smaller players, resulting in an increase in partnerships and a greater dependence on platforms like Roku and Amazon for content distribution.

With the rise of major players like Netflix and Disney and their growing ad-supported offerings, smaller video programmers like Tastemade are seeking opportunities to expand their market share through partnerships and scaling up. Indeed, CTV is increasingly favoring a select few winners who dominate the majority of spending.

In light of those circumstances, it is possible that numerous independent content players will opt to discontinue their standalone CTV apps and explore the option of partnering with platforms such as Roku or Amazon, or various FAST (Free Ad-Supported Streaming Television) networks. Due to this, it is expected that a greater portion of advertising funds will be directed towards the platforms, rather than the independent publishers. Just like in the gold rush, there might be greater profits in selling tools rather than actually mining for gold.

5. Retail Media Landscape and Analytics.

As the retail media landscape continues to evolve, it will transform into powerful analytics platforms that have a significant impact on digital advertising. These platforms will seamlessly integrate with connected TV and digital publishing, leveraging a wealth of online and offline consumer data.

In 2023, retail media made a significant impact, and in 2024, they are poised to solidify their position even further. We will prioritize offsite targeting to enhance our reach and strengthen our presence in search advertising. Additionally, we plan to explore open programmatic by adopting ID solutions. Anticipate a growing convergence between retail media, digital publishing, and CTV as retail platforms explore fresh opportunities to tap into and enhance their audiences.

Retail media offerings are expected to transform into comprehensive analytics platforms, providing brands with valuable insights into their market share and customer behavior, regardless of their engagement with retail media. Companies that can tap into this new opportunity will find great success, particularly those that can bridge the gap between online and offline realms, like developers of loyalty schemes. We will all be receiving points and rewards on everything, but our data will be the ultimate valuable asset.

6. The BOOM in AI Industry

The AI industry is experiencing a significant boom, with a surge in dedicated roles and consultancies that are transforming digital advertising through the use of innovative data utilization and automation.

AI is projected to give rise to a distinct industry by 2024. Anticipate encountering numerous recently appointed AI officers, and for specialized AI consultancies to appear at every exhibition. In the fast-paced world of digital advertising, where constant evolution is the norm, the real concern lies not in AI taking over jobs, but rather in a company that has successfully embraced AI and is now luring away clients. These transformative efficiencies will include rapid creative versioning, automated media planning, and generative data “storytelling”.

After the excitement of AI in 2023, we will see the emergence of two types of services: specialized AIs that are trained on an organization’s specific data, and general AIs that are available to anyone but may not deliver impressive results. As an experienced agency with a wealth of performance data, we can develop a customized model to replicate our past successes in future campaigns. Imagine the immense value of data when every company has its own AI eagerly devouring it.