Some mutual fund investors are concerned about the recent change enforced by the Securities and Exchanges Board of India (Sebi), which has made Aadhaar the sole Officially Verified Document (OVD) for KYC verification. Investors face a problem when the status indicates ‘KYC REGISTERED’, as they are then unable to invest in a new fund house.

They need to validate the KYC by going through the KYC process again using Aadhaar, in order to obtain a ‘KYC Validated’ status for investing in a new fund.On April 16, 2024, an investor named Vineet Hetamasaria posted on the X platform, expressing frustration about a pending KYC updation with NSE KRA (Dotex) since April 2nd…There has been no progress, and my conversations with different AMC indicate that this is a recurring issue with NSE KRA, with little to no response.

Several investors have raised similar concerns about brokerage houses. On the other hand, brokerage houses and Sebi intermediaries express their inability to help as KYC validation is the responsibility of KRAs.

We apologize for the inconvenience, as we have received feedback from multiple investors. We rely on the KYC Registration Agency (KRA) for the most up-to-date KYC status. As soon as we received the updated status from the KRA, we promptly notified you.

How do things work?

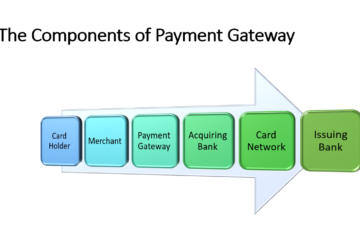

In India, there are five KYC Registration Agencies (KRAs) – CAMS KRA, CVL KRA, Karvy KRA, NSDL KRA, and NSE KRA, which help to clarify the situation. Brokerage firms, mutual fund distributors, or Sebi RIAs are market intermediaries that are required to register with these KRAs.

They handle client onboarding and submit the necessary documentation to the appropriate authorities for processing. Investors have the option to submit their KYC directly to KRAs, either in person or through online channels. In the end, it is the responsibility of one of the KRA to determine if an investor is KYC compliant.

Sudheer M, a Sebi RIA, mentioned that the issue began on April 1. They began utilizing Aadhaar as an Officially Valid Document (OVD) from that point forward. If any other identity cards are provided as OVD, your KYC status will be updated to ‘KYC registered’.If you have non-Aadhaar identity documents as OVD, you can still invest in existing mutual funds with your current status.

However, when investing in a new mutual fund, the new mutual fund house will require you to validate your KYC. Many individuals did not have Aadhar as their primary OVD, so a significant transformation is underway, and numerous people have successfully switched their OVD to Aadhar and achieved KYC validation.

However, with conflicting directives from higher-ups, the situation becomes more intricate. Mahesh Mirpuri, a mutual fund distributor, pointed out a common confusion: “Many individuals I am acquainted with have used bank statements as address proof and PAN as identity proof.” All of these are now classified as KYC registered.

According to official communication, starting from April 1, individuals who have provided proof of identity (POI) or proof of address (POA) such as Aadhaar, passport, driving license, voter ID card, NREGA job card, etc. will not encounter any issues with KYC. However, those who have submitted bank statements will face difficulties and will need to undergo Re-KYC.

Those of us who opted for bank passbooks instead of official six valid proofs were expected to be impacted, but we were still able to invest in old folios without any mention of “validation or KYC validation.”

On April 1, 2024, Mahesh received notification from KRAs about a new “KYC validated” status. It was explained that even if one had provided any of the six valid OVDs, it would be considered ‘KYC registered’ only if it was validated using Aadhar.

“In order to be validated, you need to submit your Aadhar. This means that individuals who have provided bank passbooks or any of the five other officially accepted OVDs will fall into the ‘KYC registered’ category,” clarified Mirpuri. Only Aadhar will validate your information.

According to Mirpuri and Sudheer, many investors have found the validation process using Aadhar to be smooth and effortless, with successful outcomes. However, numerous individuals encounter difficulties.

This is a window that appears on top of the main content.

Commencement of dialog window. You can cancel and close the window by pressing the escape key.

Dialog window has ended.

Issue Encountered During Aadhar Validation

Sudheer mentioned that individuals from South India often face difficulties when attempting to update their KYC status to validated. This is because many of them have different names on their Aadhar and PAN cards.

A resident of Kozhikode in Kerala mentioned that his wife’s name differs on her Aadhar card and Pan card. On the Aadhar card, her name is listed as Shreya V l (name changed for privacy), while on the Pan card, it is mentioned as Shreya Valayil.

She was required to include her full name on her Pan card, as per the rules, instead of just using initials. When attempting to validate KYC online, there was a discrepancy between my Aadhar and PAN numbers. She can now visit any Aadhar enrollment center to update the name on her Aadhar card. However, this could potentially lead to discrepancies with her other documents such as her driving license or high school certificate, which may pose challenges in the future.

If individuals are experiencing difficulties due to discrepancies in their names on their Aadhaar and other documents, they have the option to personally visit fund houses or KRAs for resolution. Additionally, Sudheer has a suggestion: “During the process of linking PAN and Aadhar through the income tax portal, there is a requirement to provide the ‘Name as per Aadhar’ and ‘Name as per PAN’.” Furthermore, having two columns provided during KYC validation can greatly reduce confusion.

According to Sudheer, NRIs are facing difficulties as their Aadhar is linked to phone numbers in India, causing issues when OTPs are sent to those numbers.

Mirpuri pointed out the challenges that investors encounter when attempting to physically validate at KRAs. My family member attempted to validate KYC in person at KRA, but unfortunately, the QR code on their Aadhaar could not be scanned. We had to complete the validation process online. Online validation is typically completed successfully in the majority of cases. But will older individuals have the ability to do it online? According to him, the majority of young investors remain unaffected.

Another issue arises when there are changes to your email ID or contact number, resulting in your KYC status being placed on ‘KYC On hold’ status. If you have completed your KYC using a mobile number and subsequently changed your number, you will not receive their message.

If your KYC status ends up with a ‘KYC On Hold’ status. However, mutual fund distributors like myself have made sure that our clients’ KYC status is not on hold. Most of them have been validated and only a few are currently in the process of being registered for KYC. We expect to complete the validation soon,” he added.

If your mutual fund KYC status is pending, your account will be temporarily frozen. These actions would not be available to you: buying or selling units, switching between funds within the same fund house, or redeeming your investments.

KRAs are facing a challenging situation, and it’s understandable considering the large number of investors trying to validate their information since April 1. This influx of requests may pose difficulties for them to handle. Once systems are established to validate one of the six documents, individuals can easily verify them. Until then, it is recommended to temporarily suspend the implementation of the new rule,” he suggested.

Steps for Validating Your KYC Online

Visit the official CDSL KRA website karvykra.com or any other KRAs to check your KYC status. Next, select ‘KYC enquiry’. Please provide your PAN number and Captcha, and then click on Search Now. Verify the status and confirm if it is “Validated.” If the status indicates “Registered” or “On hold,” it is necessary to validate your KYC.

Obtain your PAN Card, Aadhar Card, and a copy of your signature. Next, visit the KYC verification link provided by your Mutual Fund house. Please provide your PAN number and date of birth, and kindly confirm that you possess the required documents. Now, it’s time to verify your contact information and make any necessary changes. Follow the link provided to complete the Aadhar-based verification process by entering your Aadhar Number. Please use the Mobile OTP to proceed and then enter the Digilocker Pin in the next step.

Verify the information of Proof of Address using Aadhar and proceed to the next step. Capture an image, include a User Code, and submit your digital copy of your signature.

Preview and download the completed form for future reference. Click on e-Sign and submit. Once your KYC is processed and approved, you can effortlessly begin investing in new funds.

Starting from April 1, mutual fund KYC will accept six documents as valid identification, including Aadhaar, passport, and driving license.