The Finance Bill 2023 Was Tabled in Parliament by India’s Finance Minister Smt. Niramla Sitharaman on 24th March 2023.

Here are the Key Amendments passed in the Finance Bill:

- Applicability of Liberalized Remittance Scheme for Payment of Foreign Tours through Credit Cards : It has been observed that the payment made through Credit Card for Foreign Payment are not included under Liberalized Remittance Scheme. Reserve Bank of India has been requested to re look this matter and include Foreign our Payment via Credit Cards under LRS Scheme and and under the scope of Tax Collection at Source.

- Increase in withholding Tax Rate and Royalties and Technical Services Fee for Non Residents increased to 20% from previous Rate of 10%: The withholding Tax Rate increase may have direct repercussion’s in the form of increase in the cost of import of Technology where Indian Companies are grossing up withholding taxes and any bilateral tax treaty is not available.

- Formation of GST Appellate Tribunals: GST Appellate Tribunals will be formed all over the country with Head Quarters in Delhi and it will be headed by retired Supreme Court Judges and High Court Judges .

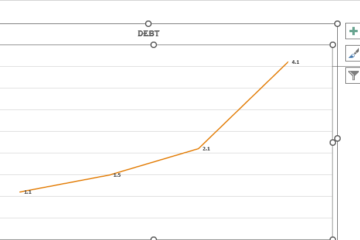

- Taxation on Debt Mutual Funds: Income from Debt Mutual Funds which invest upto 35% in equity shares of domestic companies will be taxable at application rate since income from equities in such funds do not constitute interest income. It scraps the long term benefit of Debt Mutual Funds investing less than 35% in equity. This will include all mutual funds and schemes such has hybrid funds that invest majorly in debts but their equity investment is 35 % of their total investments .

- Increase in Securities Transaction Tax from 10% to 20% : The Securities Transaction Tax on F&O(Futures and Options) Transactions has been increased from 10 to 20%.This has been done to discourage excessive trade in F&O Segment in which traders lost a lot of Money. This was done after a report regarding this was received from SEBI. However, it may reduce the number of traders in future due to high margin of points needed to convert profits.

- Tax Distribution from Business Trusts as Income from Other Sources- The Tax distribution from Business Trusts will be treated as income from other sources .It will help in pacifying the Real Estate Investment Trusts and Infrastructure Investment Trusts. It is proposed to be treated as return of capital by reducing the cost of acquisition of the Units as far as the issue of price of Units.

- Angel Tax Provisions for Start Up Investments: The angel tax provisions for investment in startups , the Finance Ministry has mentioned stakeholders issues regarding executing the proposed changes would be addressed. The draft rules for valuation of startups and exclusions which are currently provided to domestic venture capital funds shall be looked after and the exclusions will be considered for overseas entities too.