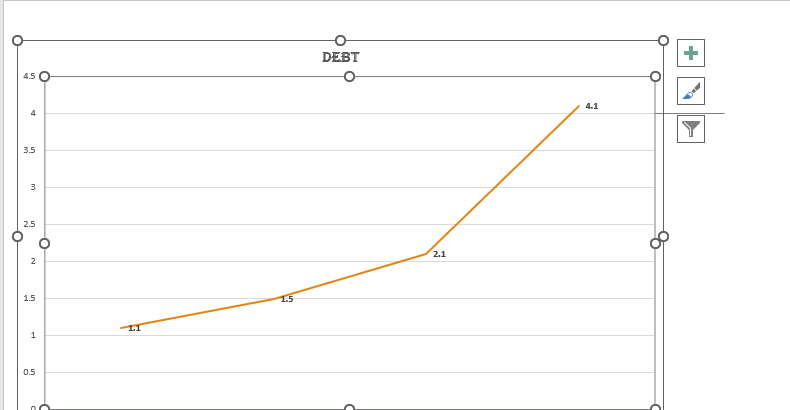

As per a latest report published by RBI in April 2023, the Credit card Debts are rising fast. The current credit card debt outstanding is reached to 2.10 lakh crore . Refer a detailed report on this. The increasing credit card debt is ominous or non-ominous we will discuss .

Credit Card Debt -Growing Consumer Confidence or Over Dependence on Credit.

The Billion Dollar question about increasing Credit Card debt in India is whether it is growing confidence or deleting savings. While it is good to spend via Credit Cards , if it is for an offer or reward points .To use Credit cards for extravagant spending might people towards debt. Credit limit utilization shall not be more than 20% of total limit at any time. If it is increasing more than 20% , it is a danger alarm .

Household Savings at all time Low in India and the Credit Card Spending

The Household saving is at all time low since 1976. It was 7.2% of total GDP in 2021-22. It has fallen further to 5.2% of total Indian GDP in 2022-23. When savings deplete, how do we spend? We spend through Credit, which is showing in increased credit card debt at record level. Increasing Credit Card debt in such a scenario becomes a big problem. Refer a detailed report on this .

The Credit Culture and Habit of Paying Minimum Due on Card Amount Monthly

The habit of paying minimum due on cards and not paying full amount is a vicious cycle. It inculcates a bad habit of paying less every month. The consumer doesn’t understand that they pay 40% interest on the remaining amount. The interest is compounded monthly. It leads the users in a never ending debt trap which wreaks havoc in their finances .

Remember Credit Card is a Loan

Consumers should not forget that the amount spend on credit card is a loan which they need to pay in next month billing cycle. The payment of minimum due only worsens the repayment cycle. The minimum due payment is not good for your CIBIL too. It shows your inability to pay debt in full at the time of billing cycle.

Future of Credit Card Spends and Debt in India

The debt of 2.10 Lakh crore as in April 2023 will increase to more than 4 Lakh crore by 2024 tentatively. Tis is because the compound of debt interest is way faster than saving interest growth. We only can hope that users spend less via Credit cards and pay more via Debit cards.

The ray of Hope in increase in Household savings

The Culture of saving money shall increase in future and dependence on credit for spending shall decrease. It will make the consumer life much more easier. Remember debt is always to be paid, while interest on saving is always to be used and utilized. Hence, save more to have a better future for you and your family and spend less via Credit Cards.

I fortunately discovered this brilliant website recently with amazing content for subscribers. The site owner understands how to produce quality material. I’m excited and hope they maintain their excellent efforts.