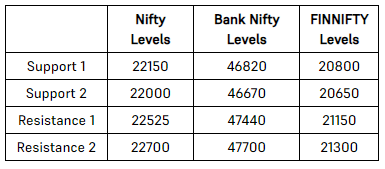

NIFTY Outlook for Next Week from 1st April 2024.

Last week was a shortened trading week with only three sessions, but it was filled with plenty of activity as the index experienced a rapid rebound in just three days. The Nifty came close to reaching the previous all-time high above 22500 on the expiry day and closed just above 22300, recording weekly gains of around 1%.

After a corrective phase of around 800 points, Nifty regained momentum last week and experienced a significant rally. The RSI oscillator indicated a positive crossover on the daily chart, suggesting a favorable momentum. The index experienced a slight cool-off in the last hour, but it is currently trading within a rising channel. The support zone is located between 22150-22100, with another zone between 21900-21850. Any declines towards this range may attract buying interest as the overall upward trend remains unaffected.

At the upper end, there is a hurdle at 22525, which coincides with the previous swing high. After overcoming this obstacle, there is potential for the index to make a strong push towards the range of 22700-22750. This level represents the upper boundary of the channel and also corresponds to the retracement level of the recent corrective phase. Therefore, it is recommended that traders adopt a strategy of buying on market dips and seek out specific stocks with potential for buying opportunities.

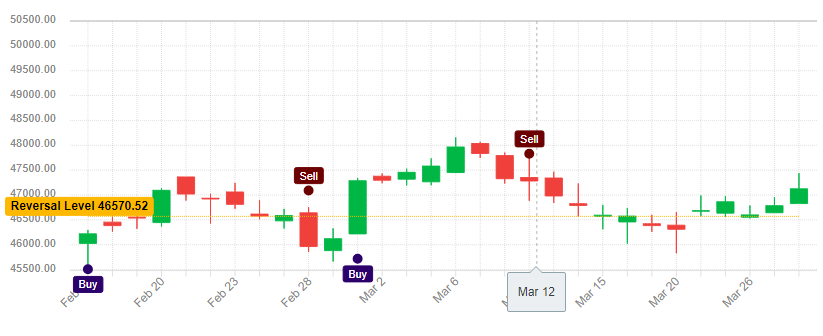

Bank Nifty Outlook next week from 1st April 2024.

The Bank Nifty index has successfully broken through its resistance level of 47000, indicating a positive trend. Additionally, the RSI oscillator on this index has also shown a positive crossover, further supporting the upward momentum. Therefore, stocks from this sector may drive the rally, and the Auto index also appears promising as it has performed better than other sectoral indices during the recent correction and is now trading at new highs, suggesting that the uptrend may continue.

The previous week concluded on a negative note for NIFTY BANK, with a loss of 1.92%.

From a technical standpoint, the NIFTY BANK share price is expected to find support at 46,622.28 and face resistance at 47,533.68.

Bank Nifty Potential and Support Level

If the NIFTY BANK share price falls below the immediate support level of 46,622.28, there is a possibility of a significant decline. The NIFTY BANK share price is expected to find significant support at 46,119.97 for the upcoming week.

There is a potential upside as the immediate resistance level is at 47,533.68. With a closing above 47,533.68, the share price of NIFTY BANK is poised for a significant breakout. There is a significant level of resistance for the NIFTY BANK share price at 47,942.77 for the upcoming week.

The projected trading range for NIFTY BANK share price for this week is expected to be between 45,710.88 on the downside and 48,445.08 on the upside.

Last week, the NIFTY BANK reached a high of 47440.45.

Last week, the NIFTY BANK reached a low of 46529.05.

Last week, the NIFTY BANK had a range of 911.39999999999 points.