In the dynamic realm of technology, payment gateways have become essential tools for businesses, enabling secure and smooth transactions. It’s a global phenomenon, with the Global Payment Gateway Market Size projected to reach 162.68 billion by 2031.

The estimated size of the India Payment Gateway Market in 2024 is USD 1.21 billion, with a projected growth to reach USD 2.66 billion by 2029. This indicates a significant compound annual growth rate of 17.16% during the forecast period (2024-2029).

The increase in card transactions and other products such as UPI has also been quite promising. According to the RBI, the transaction value of debit cards reached INR 6.8 trillion, while the transaction value of credit cards reached INR 7.1 trillion. These figures indicate a year-on-year growth of 21% for debit cards and 33% for credit cards in 2019 and 2020, respectively

In today’s modern era of digital transactions and credit card payments, a payment gateway plays a crucial role in enhancing the efficiency and speed of the payment process for individuals and businesses alike. Therefore, these new gateways have a significant impact on various industries in the modern world, including financial services, trading, e-commerce, retail, and more. There are various payment gateways available in the market, each with its own advantages and disadvantages. Let’s take a closer look at each type of gateway to find the one that best suits your software.

Components and Workflow of a Payment Gateway

Payment gateways are essential tools for businesses to securely process online payments from customers through their websites or mobile apps. It acts as a middleman between a merchant and the financial institution that handles the payment.

This payment gateway goes beyond the typical card reader or point-of-sale device found in traditional brick-and-mortar stores. It includes a payment processing terminal that is seamlessly integrated into a digital platform.

Prior to discussing the various types of payment gateways, it is essential to understand the fundamental elements and workflow involved in a payment gateway, starting from when the user initiates the checkout process until the transaction is successfully completed.

Components of Payment Gateway

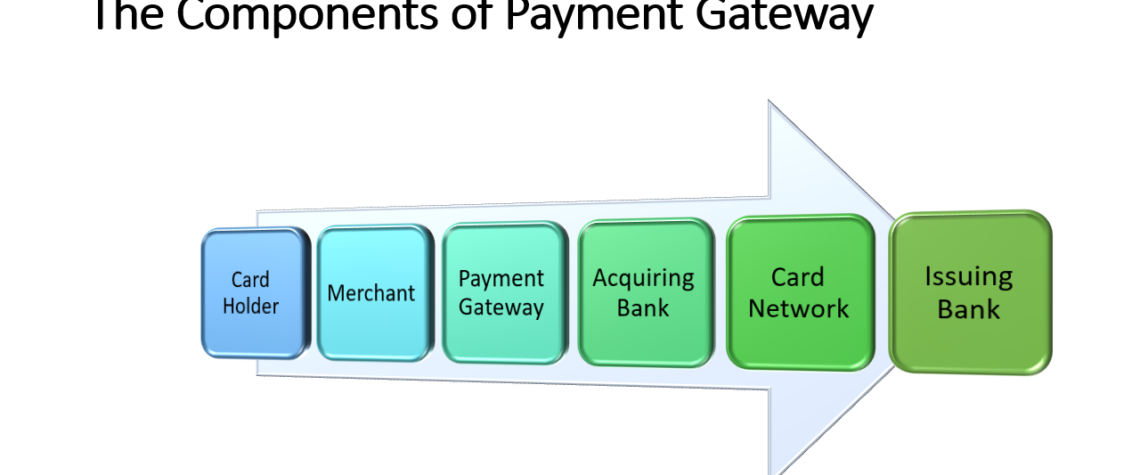

Several components collaborate in a card payment system to enable transactions. These components consist of cardholders, merchants, acquiring banks, issuing banks, and payment networks.

Cardholder:

The customer who chooses to make a payment for goods or services on your website. People or companies who possess payment cards such as credit, debit, or prepaid cards. They utilize these cards to initiate transactions through making purchases.

Merchant:

Businesses that process card payments from customers. They utilize point-of-sale terminals or online payment gateways that are connected to acquirers.

Acquiring bank:

The bank responsible for the backend processing of transactions handles the processing of card payments for merchants.

Payment networks:

Payment networks, such as Visa, Mastercard, American Express, or Discover, facilitate the connection between issuers and acquirers. They are responsible for developing network rules, facilitating funding exchanges between parties, and managing aspects such as fraud prevention.

Issuing bank:

The bank provides payment cards to individuals and businesses. They handle cardholder accounts, establish credit limits, collect fees and interest, and handle authorization and settlement procedures.

Workflow

Let’s take a closer look at the roles and interactions of each component involved in facilitating a card payment transaction.

Step 1: During the checkout process, users (cardholders) begin their purchases by providing their card details to merchants.

Step 2: The merchant securely sends the card information and transaction details to the payment gateway (the method used to transfer card data may vary depending on the chosen payment gateway).

Step 3: The payment gateway securely encrypts card information and conducts fraud checks before transmitting the card data to the acquiring bank.

Step 4: The acquiring bank proceeds to send card data to card networks for fraud checks and directs it to the issuing bank based on card information.

Step 5: The issuing bank approves and finalizes the payment. Ultimately, it sends the transaction status back to the merchant for processing and informs the user of the outcome of their order.

Every component has a vital role in facilitating the transaction, guaranteeing the seamless flow of information and funds between cardholders, merchants, acquirers, issuing banks, and payment networks.

Types of Payment Gateways

Prior to selecting a payment gateway that aligns with your business requirements, it is crucial to consider your business needs and infrastructure. There are three common types that you can consider: re-direct payment gateway, offsite payment gateway, and on-site payment gateway.

Re-direct payment gateway

The re-direct payment gateway functions by guiding the customer away from your checkout page. This method provides a comprehensive solution for handling the payment page, encompassing tasks such as collecting the user’s card information, processing the payment, and ensuring strict adherence to PCI security standards. Specifically, when the user selects the ‘Pay now’ button, they will be directed to the page of the host or payment service provider (PSP). Once the payment has been processed, the user will be directed back to the business website to finalize their order.

This payment gateway is ideal for businesses with limited resources who want to prioritize the development of other aspects of their website.

Offsite payment gateway

Taking it to the next level, the offsite payment gateway allows you to personalize your payment page and securely gather card details directly on your website. The data is sent to the backend site for payment processing using a third-party payment gateway.

Offsite differs from re-direct in that it does not direct users to separate sites. This approach greatly improves the user experience by allowing for easy customization of the payment page. Furthermore, this approach enhances the user checkout process by seamlessly integrating the payment gateway on the backend site.

On-site payment gateway

This payment gateway enables merchants to provide a seamless payment experience on their website. This method is commonly utilized by merchants with extensive systems and highly specific requirements.

When setting up an onsite payment gateway, it is crucial to prioritize its security. Your team is responsible for ensuring the system’s PCI compliance and covering the cost of the SSL certification.

Summary

Having a thorough understanding of the different payment gateway types is essential in order to select the most suitable option. It’s important to consider factors such as price, security, business requirements, the stage of product development, and the capabilities of your team.

Indeed, a system can accommodate multiple payment types. For instance, you can manage an offsite payment gateway that supports Credit Card, PayPal, and Google Pay simultaneously. However, a payment product has the capability to accommodate various payment types, including Stripe, which offers both re-direct and offsite payment options.

Additionally, there are mobile payment options that are limited to specific devices. Apple Pay can be used on Apple devices, while Samsung Pay is only compatible with certain Samsung devices.