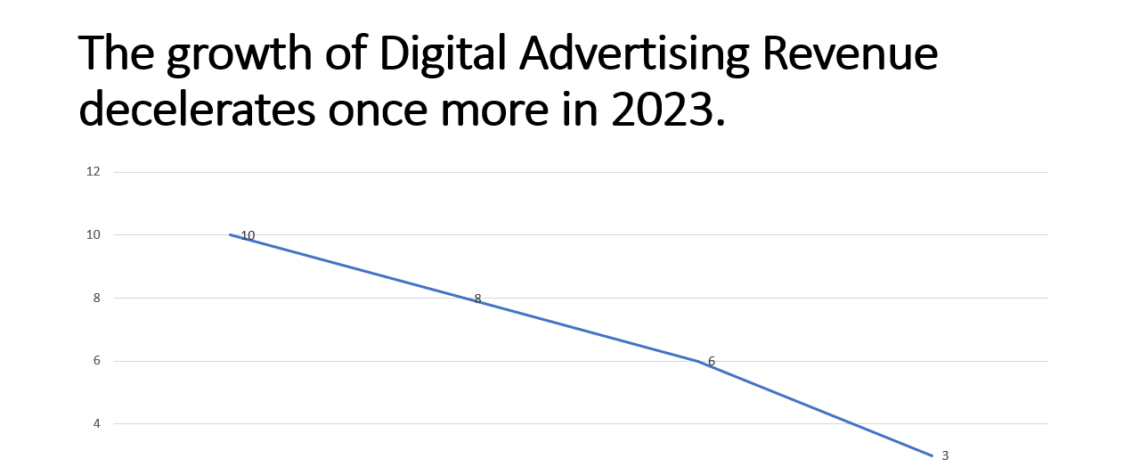

There is nothing that endures eternally. Two years in a run, ad revenue growth slowed following astronomical gains in the aftermath of the COVID-19 pandemic.

According to the IAB/PwC Internet Advertising Revenue Report released on Tuesday, inflation, rising interest rates, and unemployment in the advertising industry slowed the growth of digital ad revenue in the United States in 2023 compared to 2022.

Digital advertising revenues surpassed $209.7 billion in 2022, an increase of 7.3%. Nevertheless, advertising revenue increased by double digits on average annually in 2022, at 10.3%.

Multiple ad formats, including CTV, audio, and programmatic, experienced a correction in some way as a result of the pandemic’s meteoric revenue growth. In addition, overall revenue growth lagged behind the wildest post-pandemic expansion of 35.4% year-over-year in 2021.

Nevertheless, digital advertising revenues in the United States escalated to an all-time peak of $225 billion in 2023.

“We continue to expand at a healthy rate,” stated Jack Koch, senior vice president of research and insights for the IAB. “We’re observing a normalization, or a bit more of what we’re accustomed to seeing.”

The development triumphants

Despite experiencing a deceleration in growth when compared to previous years, programmatic ad revenue increased by $4.8 billion, subsequently expanding 4.4% in 2022 to attain $114.2 billion.

The revenue of digital video, retail media, and audio exceeded the average growth rate of 7.3%. In 2023, digital video revenues, encompassing online and cable television, increased by 10.6% to $52.1 billion. The report predicts that by 2024, CTV/OTT will be the media channel with the highest rate of growth. Streaming services will continue to negotiate live sports licensing agreements, introduce additional ad tiers, and refine their ad-supported models.

Retail media advertising networks experienced tremendous growth in 2023, reaching $43.7 billion, an increase of 16.3%. Additionally, its growth is expected to persist at a rapid rate. Koch stated, “Everyone with a retail front is establishing a retail network.” Digital audio revenues experienced a marginal increase of 18.9%, resulting in a significantly reduced total of $7 billion.

In contrast to retail and CTV, which have been dominant for some time, social media experienced a recovery in 2023 following a decline in 2022. Revenue from social media rose 8.7% between 2022 and 2023, reaching $64.9 billion. Koch stated that the channel’s recovery was aided by the robustness of the creator economy.

Their content “collapses the marketing funnel” when consumers utilize YouTube Shorts, Instagram Reels, and TikTok videos for activities ranging from product research to purchasing. As a result, content creators frequently cater to niche interests. Concurrently, advertisers have enhanced their capacity to execute brand-safe, quantifiable campaigns on content generated by creators. Koch asserts that brand safety and measurability are prerequisites for transforming a niche channel into a mainstream one.

Not every channel performed as well. Display revenue increased by 12% in 2022, but decreased by 4% to $66.1 billion in 2023, as an increasing number of advertisers shifted their advertising budgets to video. Furthermore, despite a 5.2% surge in search revenue to $88.8 billion in 2023, its proportion of overall digital advertising revenue has declined consistently from 43.9% in 2019 to 39.5% in 2023.

Bumps in the road ahead

The IAB report analyzes industry-wide concerns that warrant the attention of advertisers, in addition to revenue trends. For example, privacy is not diminishing in importance. An increasing number of states are enacting legislation pertaining to data privacy, while the prospect of a federal statute protecting consumer privacy continues to intensify.

Organizations are progressively becoming more cognizant of the constraints surrounding the information that their clients are willing to divulge. Koch stated that they are implementing consumer opt-ins and assuring that customers can access and request the deletion of their data. Furthermore, he observed that numerous advertisers are employing diverse strategies, including first-party data, CDPs, data clean rooms, and others, to target addressable audiences.

Koch cited retail media and CTV as instances of channels that effectively adapted to the transformations brought about by data-driven advertising. The IAB is monitoring additional M&A activity that could be comparable to Walmart’s purchase of Vizio this year. Alternatively stated, strategic maneuvers that integrate the capabilities of CTV and retail media in terms of reach, targeting, and measurement.

The IAB is continuing to monitor generative AI as well. Already, advertisers have shown that generative AI tools are capable of generating ad creative, which can reduce production costs and boost efficiency. The complete potential of AI is yet to be determined; however, with the increasing acceptance of the technology, the IAB will contemplate whether it will ultimately be featured as a distinct category in a future report.