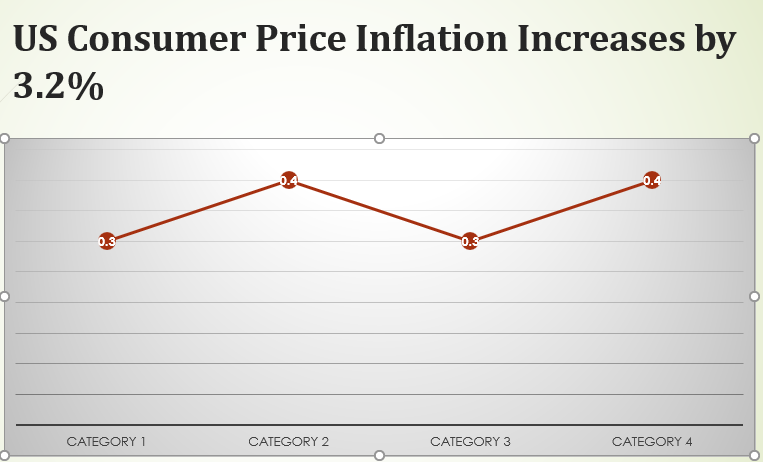

Last Night US released consumer inflation data for the month of February 2024.

The broad gauge of the cost of goods and services, the consumer price index(CPI), rose 3.2% from a year ago and by 0.4% last month. While the 12-month reading was somewhat higher, the monthly measure was in line with forecasts.

The core Consumer Price Index increased (CPI) 0.4% in the month and 3.8% in the year. Both were greater than expected by a tenth of a percentage point.

Headline Inflation Rate increases by 2.3%

The headline inflation rate was increased by 2.3% due to a rise in energy expenses. While housing expenses increased by 0.4%, food expenditures were unchanged for the month.

The Federal Reserve is still planning to hold off on cutting interest rates until the summer, at least, as inflation increased in February.

Bureau of Labor Statistics of the Labor Department Data

According to a study released on Tuesday by the Bureau of Labor Statistics of the Labor Department, the consumer price index—a broad indicator of the expenses of goods and services—rose 3.2% from a year earlier and by 0.4% for the month. Although the yearly rate was little higher than the 3.1% consensus estimate from the Dow Jones consensus, the monthly gain was as anticipated.

With volatile food and energy prices excluded, the core CPI increased 0.4% in the month and 3.8% annually. Both were greater than expected by a tenth of a percentage point.

Even if the 12-month pace is below the mid-2022 inflation peak, it is still much higher than the Fed’s 2% target as the central bank gets closer to its two-day policy meeting next week.

Over 60% of the entire gain was attributed to the increases in energy and shelter, according to the BLS. In the same month, gasoline prices increased 3.8%, and owners’ equivalent rent—a proxy for what homeowners would be able to charge for their properties—went up 0.4%.

Shelter and Housing Inflation

“Inflation is still running over three percent, with housing expenses emerging as the primary culprit once more. According to Robert Frick, corporate economist at Navy Federal Credit Union, “the long-awaited decline in shelter prices isn’t coming to the rescue any time soon, with home prices expected to rise this year and rents falling only slowly.” “Quotes like the ones from January and February won’t force the Fed to cut rates soon.”

Airline and Clothing Inflation

Airline tickets had a 3.6% increase, clothing costs increased by 0.6%, and used car prices increased by 0.5%. Last month, there was a 0.1% decline in medical care services, which contributed to January’s CPI increase that was greater than anticipated.

The headline CPI increased by 0.1 percentage points year over year in January compared to a tenth of a point decrease in the core.

Impact on Wall Street

Following the data, Wall Street began trading higher, with key stock indexes and Treasury yields both rising in the early going.

Even if the 12-month pace is below the mid-2022 inflation peak, it is still much higher than the Fed’s 2% target as the central bank gets closer to its two-day policy meeting next week.

Federal Reserve Comments on Views on current Inflation Data

In recent weeks, Federal Reserve officials have indicated that rate reductions are probably coming later this year and have cautioned against giving up on the fight against rising prices too soon. In the press release following the January meeting, it was said that policymakers require “more assurance” that inflation is returning to goal.

In testimony before Congress last week, Chair Jerome Powell highlighted these worries, adding, however, that the Fed is likely “not far” from the point at which it may begin loosening monetary policy.

Paul Ashworth, chief North America economist at Capital Economics, stated that the Fed members are still a long way from having “greater confidence” to start lowering interest rates in light of the report released on Tuesday.

The Fed’s apparent policy reversal in late 2023 has resulted in a repricing of rate decreases, which has affected the financial markets. Futures traders moved out the first reduction to June, with two or three more to follow, assuming cuts in quarter percentage point increments, when they had anticipated cuts to begin in March and end up with six or seven for the year.

An expanding economy has made it easier for the Fed to pay attention to new data and has spared decision-makers from needing to act quickly to cut rates. According to the GDP Now tracker maintained by the Atlanta Fed, the gross domestic product grew at an annualized pace of 2.5% in 2023 and is expected to continue growing at the same rate in the first quarter of 2024.

A solid labor market and resilient consumers have been major contributors to that expansion. In February, the economy created an additional 275,000 nonfarm jobs; however, the growth was primarily concentrated in part-time work, and the unemployment rate increased to 3.9%.

Such power has two potential drawbacks: Although the Fed has gained some leeway in policy decisions due to the growth in the face of aggressive rate hikes, there are worries that inflation may prove to be more resilient than anticipated.

In particular, housing expenses have raised concerns.

At least by the BLS estimate, shelter makes up roughly one-third of the CPI weighted and has been slowly declining. In addition to other metrics showing easing price pressures outside the CPI computation of owners-equivalent rent, Fed officials expect rental prices declining throughout the year.

Thank you for your message! It seems like you’re referring to the repetitive nature of the comments provided earlier. If you have any specific questions, topics, or concerns you’d like to discuss, please feel free to share them. Whether it’s about technology, science, literature, or any other subject, I’m here to assist you. Just let me know how I can help you further!